US: Initial reactions to Trump's "reciprocal" tariffs - minimal retaliation, lots of negotiations, early signs of cooperation

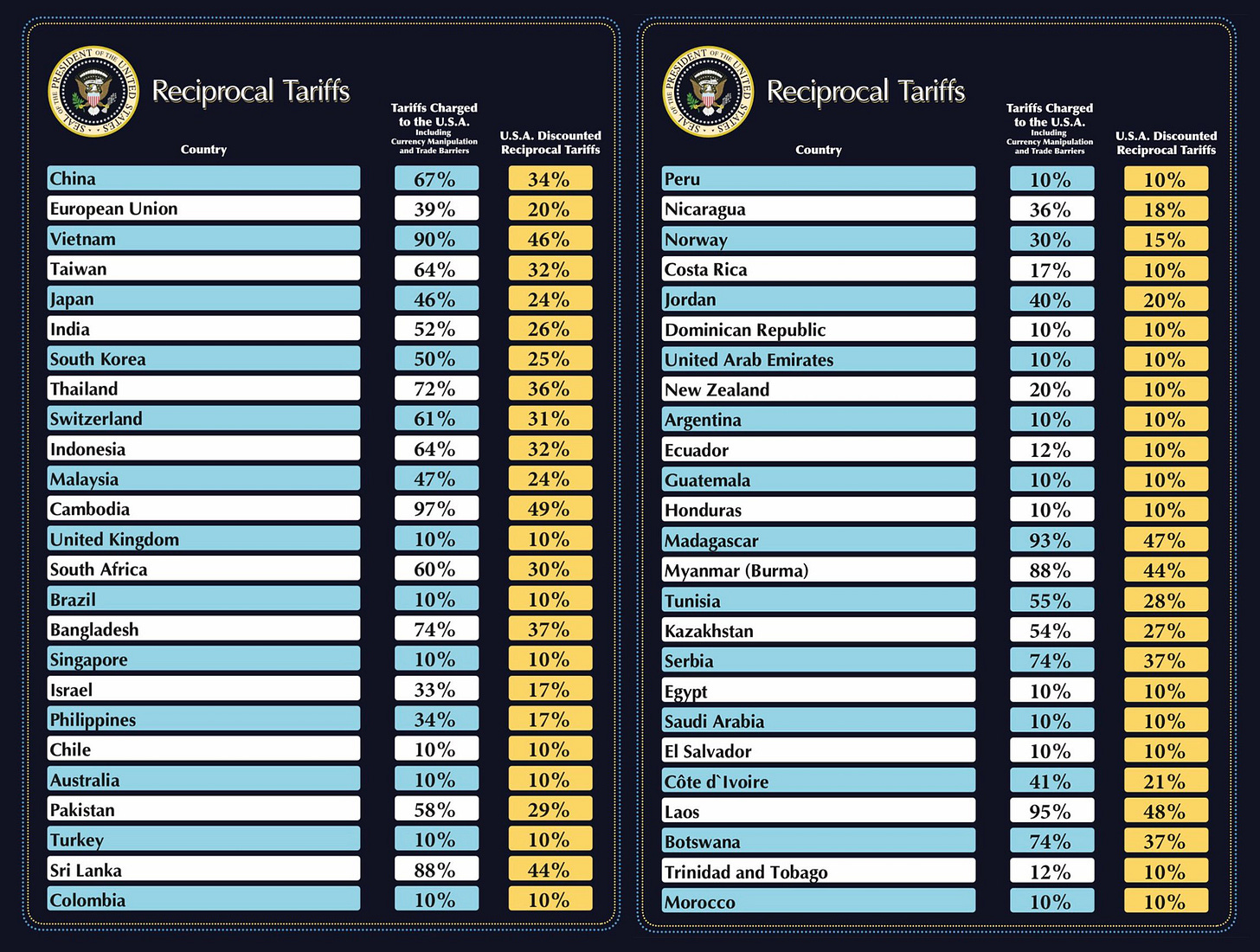

A week is now a long time in trade policy and for the past week I’ve been tracking the various reactions to the US’s so-called reciprocal tariffs (now paused at 10% for everyone but China for 90 days). I’ve stopped updating the table in that earlier post and, as I wait for a flight home, in this post I’ve summarised some of the interesting themes that emerged over the last week in the responses.

First, a few countries tried to pre-empt new US tariffs by dropping their own tariffs or removing other trade irritants before the tariffs were announced (e.g. Israel removed its tariffs on all US imports, India also lowered or removed some of its trade barriers). These made no difference given the mechanical application of the USTR’s tariff formula. And indeed, given the Trump Administration’s past practice, it may be that these good faith attempts have just been pocketed and more will be demanded as part of negotiating a reduction in the new tariffs.

Second, most responses either explicitly rejected the idea of retaliations or did not mention them at all. Canada, China, the European Union (EU) and Mexico are the exceptions to this, and Brazil also passed a law enabling it to impose countermeasures. This makes sense given the trade exposure of each of these economies to the US and their ability to inflict meaningful pain on the US. It also raises some interesting question on the limits the WTO places on countermeasures.1

Relatedly, very few countries explicitly raised the prospect of formal WTO or FTA disputes to contest the new tariffs (I only saw this from Australia, Brazil, Canada, and China). Singapore did the opposite, stating it would not be bringing a dispute.

Some countries also seemed almost happy to fall in a lower tier of tariffs while their competitors were slugged with more heavy duties. Although I expect this positivity dissipated with the pause and levelling of the tariffs to 10% for all except China.

Third, as the Administration has trumpeted, virtually all of the countries’ that have publicly responded have sought to negotiate a reduction in the tariffs with the US.2 Some offered specific deals (such as Argentina offering zero tariffs on 50 lines or Cambodia offering 5% duties on 19 lines), others are seeking a trade agreement (either a sectoral agreement such as the one India is negotiating3 or a full FTA like Argentina is hoping for).4 The key question with these concessions and ‘deals’ is whether the outcomes will be preferential to the US or done on an MFN-basis and in compliance with WTO obligations.

Fifth, there have also been various announcements on domestic measures to mitigate the impact of tariffs. Trade diversification strategies featured heavily. Other announcements included new export finance support, temporary loans to affected businesses, support to diversify and find new markets, and industrial policy measures. Australia is also strengthening its anti-dumping system, getting ready for trade diversion as exports originally destined for the US need to find other markets.

Finally - and perhaps of most interest to me - we saw at least two emerging initiatives to coordinate responses and reaffirm support for rules-based international trade.5 ASEAN was first out of the blocks, holding a virtual ASEAN Economic Ministers meeting and issuing a joint statement on the new tariffs. The statement included a reaffirmation of support for rules-based trade, regional economic integration, and working with Dialogue Partners to deepen economic links. News of an ASEAN Geoeconomic Taskforce also emerged, which will monitor, evaluate and recommend policies for ASEAN to respond effectively to the US.

New Zealand has also taken the lead on pushing forward work with like-mindeds to support free trade and rules in the face of the new tariffs. New Zealand’s Prime Minister held conversations with the EU, Malaysia, Vietnam, Singapore, the Philippines, Thailand, Ireland and Fiji in a whirlwind 48 hours. The EU’s readout of the call referred to discussions of “prospects for closer cooperation between” the EU and the CPTPP, so the idea of EU-CPTPP joint work (which has been percolating around various circles in various forms6) looks to be getting some traction.

Australia’s Foreign Minister also said she has been in discussions with “Southeast Asian nations, Japan, Korea, India and the EU” although Australia’s proposed approach here is less clear. As I said on LinkedIn, Australia is chairing the CPTPP Commission this year, so this would be a great opportunity for them to lead - although an election in a few weeks plus I assume some nervousness about drawing too much attention from the US could hold things back.

China’s Xi Jinping will be visiting Cambodia, Malaysia and Vietnam this coming week and China has expressed a desire to work more closely with ASEAN on trade. Closer ties with China will put these countries more in the spotlight for the US (something they’ll want to avoid if possible). Indeed, Vietnam is reported as considering cracking down on Chinese trans-shipments and tightening export controls on exports to China. Australia has also turned down an offer from China to “join hands” against the new tariffs.

All in all, there are some commonalities and lots of differences in how countries are approaching the new tariffs. It’s good to see the emergence of cooperative initiatives and also many countries looking to deepen integration outside of the US. US-China rivalry casts a long shadow over a lot of this work, and the full impact of that will also need to be taken into account as countries calibrate their responses. And of course, the problem with commenting on any of this is that it will all likely be out-of-date in the next 24 hours.

See also comments from Japan’s Finance Minister on the legality of retaliatory tariffs.

Important side note on this point, some Administration officials (see e.g. David Sacks) suggest this shows the brilliance of the tariffs as they forced countries to the negotiating table. However, I highly doubt that the chaos of the tariffs was necessary to start these negotiations (both in terms of the substance of what was done and also the process and uncertainty in how they were applied). Further, in my experience the best negotiators don’t have to resort to actually using their ‘big stick’ threat to get what they want (particularly before the negotiation even starts).

I doubt many (any?) full trade agreements could be negotiated in 90 days, particularly given the US’s interest in non-tariff barriers and broader policy issues such as Chinese investment and trans-shipment concerns which will require bespoke provisions to address (i.e. they can’t just copy and paste past agreements). This is notwithstanding Trump referring to using the hundreds of millions of dollars of pro bono work law firms have pledged to him to throw lawyers at these trade negotiations.

I’m not as across other blocs like CARICOM, but have seen suggestions of coordinated responses there too. There was also a joint statement from “Friends of the System” (a group of 39 WTO Members) at the WTO on its 30th anniversary in support of the rules-based multilateral trading system.

See also this proposal from Mona Paulson and Dan Ciuriak for a Small Open Economy Caucus (SOEC) at the WTO.